We’re all adults here, so let’s say it like it is: America is for sale. The commodity markets are rigged and have been since the 1990’s. Speculation can hurt a lot of people (some may die or lose a house) and you can bet another economic bubble (errr, Ponzi scheme) is ready to burst at some point. Some are predicting that the big bubbles are getting ready to diffuse again, including commodities. When will the next engineered crash be and what is the Grifter Class? How did the Grifter Class get in the Catbird seat? Taibbi explains Griftopia, a true crime story.

We’re all adults here, so let’s say it like it is: America is for sale. The commodity markets are rigged and have been since the 1990’s. Speculation can hurt a lot of people (some may die or lose a house) and you can bet another economic bubble (errr, Ponzi scheme) is ready to burst at some point. Some are predicting that the big bubbles are getting ready to diffuse again, including commodities. When will the next engineered crash be and what is the Grifter Class? How did the Grifter Class get in the Catbird seat? Taibbi explains Griftopia, a true crime story.

Shall we have a nice cup of tea while we talk about secret money? Americans are paying unnecessary amounts of money for food and energy due to excessive speculation. These exemptions (handed out in secrecy since 1991) have allowed speculators to distort futures markets.

The stock market is at an all-time high and speculation is wilder than ever. Energy markets are up and down and gas prices have bounced like a yo-yo. Yet even oil prices are falling at the moment (it isn’t vacation time yet, guys). Some are forecasting that the commodities market is not doing so hot; now only talk, but it could lead to a major bubble burst.

It’s still hard to comprehend such strange circumstances though. Oil supplies are up this year, oil demand is down… so gas prices should be going down, right? But instead they are going up. What’s up with that?

Once upon a time, there was a land where speculators didn’t buy up all the goods and then turn around and jack up the prices. The Commodity Exchange Act was enacted on June 15, 1936, and constructed the way the system was going to operate, under heavy regulations. There were restrictions and only a few percent could be speculators. Please take us back to this moment!

Markets were tightly regulated until the early 1990’s. Then, a Wall Street company named Goldman Sachs asked for special exemptions through its subsidiary, J. Aron, and wanted to be treated as a physical hedger, not a speculator. (Errr, they wanted to rig the markets.) And the company got its wish.

“J. Aron was a player in the coffee and gold markets, and CEO of Goldman, Lloyd Blankfein, joined the firm as a result of this merger. In accordance with the beginning of the dissolution of the Soviet Union, the firm also became involved in facilitating the global privatization movement by advising companies that were spinning off from their parent governments.”

Over the course of the following 10 or 15 years or so, more and more exemptions were handed over to other investment banks.

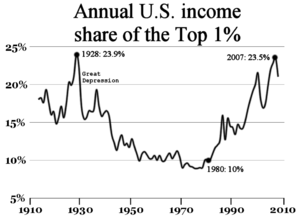

In 2003, there was only $13 billion of speculative money in the markets. By 2007 there was over $300 billion of speculative money in the commodities market! Goldman Sachs found itself in the Catbird seat and other banks soon followed suit. In 2007 and beyond we begin to see a financial meltdown and things start to get really complicated. (Remember the bailout scandal?)

There was an explosion of speculative money into the commodities market and we have a situation where gas prices go through the roof, oil reaches $147 a barrel, and 100 million people around the world join the ranks of the hungry.

Matt Taibbi, author and journalist reporting for the Rolling Stone Magazine, tries to simplify the ensuing catastrophe in his informative book, Griftopia: A Story of Bankers, Politicians, and the Most Audacious Power Grab in American History.

Down on Main Street there are numerous foreclosures happening at blazing speeds. This is a phenomenon that is being grossly underrepresented in the mainstream media. People are affected by this concentration of wealth and are being forced to get educated about the problems they are faced with.

The wealth and power has been transferred to a super-rich crowd called a Grifter Class.

The financial crisis that exploded in 2008 isn’t past but prologue. The grifter class—made up of the largest players in the financial industry and the politicians who do their bidding—has been growing in power, and this is Griftopia, folks.

Subscribe Now!

Featured Deal ➸

Social Button ➸

Categories

- 1

- 111

- 5

- 7Slots

- 9

- a16z generative ai

- Amateur Radio

- antikaeltehilfe.de

- atlantikcorner.com

- bauhutte-g.com

- blog

- Bookkeeping

- Casino

- Cryptocurrency exchange

- extension-autoroutes-non.ch

- Forex Trading

- Future Tech

- Geeky Tips

- Going Green

- Going Mobile

- News

- Pin-Up AZ

- Pin-Up indir

- Pin-Up oyunu

- Pin-UP VCH

- Post

- Product Reviews

- ready_text

- restaurantelacontrasena.com

- Scanner Listening

- Science Sightings

- Sober living

- Technology

- texts

- thomas-petandfamily.de

- Uncategorized

- Новости Криптовалют

- Новости Форекс

Archives

SQUIDBOARD

Academic Tech

Multimedia MegloMania

Tech Toolbox

- Acronis

- AN/GRC-9

- Apple Final Cut Pro

- Audacity

- Audacity VST Plug-ins

- BleachBit

- ClimateViewer 3D

- Cool Edit Pro 3.1

- CyberGhost

- Flickr

- FreeSCAN

- fring

- Fruper

- FTA Lists

- GPS Calculator

- GPS Converter

- HAMSOFT

- HF Antennas

- inSSIDer

- Levelator

- MaxMind

- Microphone Cables

- Morse Code Chart

- Old Version

- Pendriveapps.com

- PortableApps.com

- Privacy Badger

- PulseAudio

- Rowetel

- ShopJimmy

- Teleprompter Software

- TV Listings

- UNetbootin

- Voicemeeter Banana

- Winlink

RSS feed for comments on this post · TrackBack URI

Leave a reply